1947 Rise ☀️: 213

1. India to witness massive formalization of economy through tech: Nandan Nilekani

India’s economy will undergo massive formalization in the next 10 years due to the unlocking of frameworks such as the Open Network for Digital Commerce (ONDC) and Open Credit Enablement Network (OCEN) and the democratisation of skilling through the National Digital Education Architecture (NDEAR), said Infosys chairman Nandan Nilekani.

“What you are seeing in India now is a domino effect and all these things coming together … This will lead to massive formalization,” Nilekani said

“What you are seeing in India now is a domino effect and all these things coming together … This will lead to massive formalization,” Nilekani said at an event hosted by workforce management startup Betterplace in the city.

“Historically, it made more sense to be outside the system because of the informal economy. Now, being formal will be more valuable and you are going to see the great formalization of India in the next 10 years,” he added.

India to witness massive formalization of economy through tech: Nandan Nilekani

2. Another week of tepid funding for Indian startups

The torrid run of Indian startups raising big funds continued into the third week of September. Though there was some uptick in terms of the deal amount from the last week, the figures were still far away from what the startups raised before the onset of the tech winter. The number of funding rounds of $100 million and upwards has fallen from 29 in the first quarter of the calendar year to 18 in the second quarter and just three in the third quarter (as of August 24).

With large PE and VC funds still placing their bets cautiously amid the volatile macroeconomic environment, the dry spell might continue for some time.

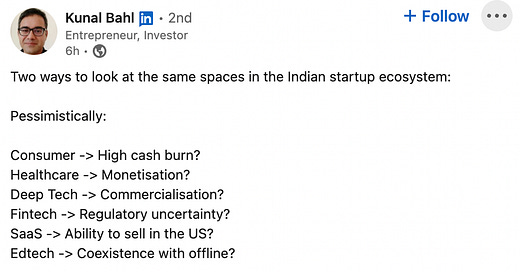

A Post:

Worth your attention:

Yulu raises $82 million from Canada’s Magna for fleet expansion, battery network Link

Google-backed payments startup DotPe raises $54.4 million in funding led by Temasek Link

AI solutions startup Sigmoid raises $12 million in funding from Sequoia Capital India Link

Artificial intelligence startup Rephrase.ai raises $10.6 million in funding led by Red Ventures Link

Cred to invest $10 million in P2P lending platform LiquiLoans Link

Healthcare SaaS startup CoverSelf raises $4.8 million led by Beenext and 3one4 Capital Link

Ethereum’s ‘Merge Day’ lifts gloom in India’s Web3 community Link

PE, VC funds with five or fewer investors attract Sebi scrutiny Link