1947 Tech 🇮🇳: 142

44 unicorns, 80x return to angels, overseas listing, snap in India and more!

1. 44 startup unicorns created $106 billion in value

Forty-four Indian tech unicorns have generated huge value for founders, employees, investors and the economy by creating $106 billion in value, resulting in direct and indirect employment of 1.4 million plus jobs annually.

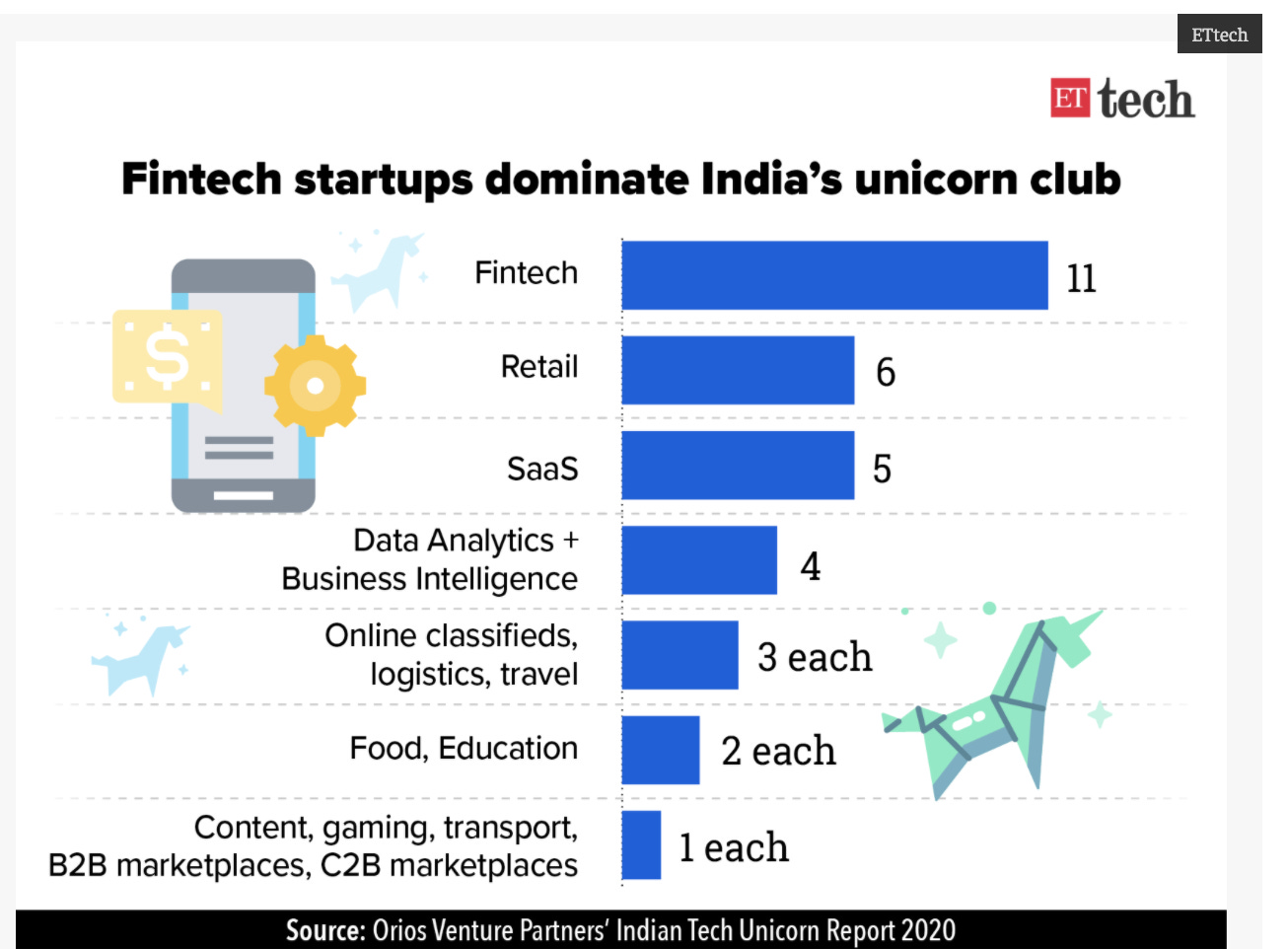

While the financial payments sector saw the maximum number of unicorns, retail and SaaS (software as a service) were a close second, the report said. Other verticals include logistics, data analytics, travel, food and gaming.

41% of unicorns are from India’s startup capital Bengaluru, followed by Delhi at 34% and Mumbai at 14%.

Startups such Naukri.com, MakeMyTrip which were founded pre-2005, took over 14 years to achieve unicorn status, while Zomato, Flipkart and Policy Bazaar took around 8.7 years. Nykaa and Oyo have taken even less time at 5.8 years while Udaan and Ola Electric have taken only three years to achieve a valuation of over a billion dollars.

2. BharatPe gives 18 of its angels an exit with up to 80X returns

Sometimes one story is what it all takes to bring a massive change. Would this bring an inflection point to angel investing in India?

In my opinion, it would certainly accelerate the pace at the least.

Fintech startup BharatPe has announced that 18 of its angel investors have exited the company after its Series D funding round. The angles have seen returns as high as 80X in two years. The statement said the company has already returned Rs 102 crore in cash to its secondary investors, as against the initial angel round of Rs 1.9 crore.

BharatPe gives 18 of its angels an exit with up to 80X returns

3. Grofers in talks with Cantor Fitzgerald’s SPAC for Nasdaq listing

It was only a matter of time. Here we go, India is about to join the SPAC mania.

Grofers is in talks to make its public market debut through a merger with New York-based Cantor Fitzgerald’s blank-check firm, sources told The Economic Times, in what could be the first instance of an Indian startup taking this lesser-known route to tap funds.

The online grocer is expected to raise between $400 million and $500 million through the listing in May — on the tech-heavy Nasdaq — at a valuation of more than $1 billion, the sources said.

Scoop: Grofers in talks with Cantor Fitzgerald's SPAC for Nasdaq listing

An infographic:

Worth your attention:

Overseas listing just got a lot easier for Indian tech companies, startups link

India begins approving new investment proposals from China: Report link

Freshworks, Eka founders to launch early-stage fund link

More start-ups are founded every year in Bengaluru than in San Francisco link

Snap plans to take its India localisation strategy to the world link

Funding:

Zomato’s valuation touches $5.4 Bn with a $250 Mn round led by Kora link

Dream11 | Scoop: Dream Sports’ valuation may double to $4 billion link

Shiprocket raises $27 million in Series C3 funding link

Edtech startup Lido Learning seeks $30 million funding from Temasek link

Vogo raises $11.5 million to expand, electrify fleet link