1. $30 Billion Fundraising, 40 Unicorns In 11 Months — Startups Break Records, Spark…

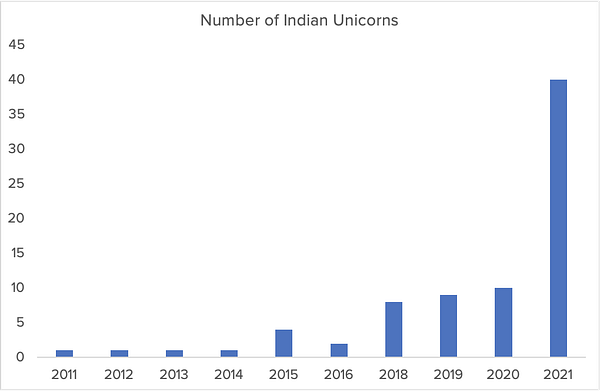

Indian startups have raised over $30 billion in 11 months of 2021 from investors, many times previous records and made billion-dollar startups commonplace, even as the unprecedented boom sparks fears of a bubble.

Privately held startups have raised $31.2 billion, nearly three times 2020’s $11.2 billion, and more than double the previous record of $13.1 billion in 2019. The number of deals however has increased in a less significant way, from 877 deals in 2019 to 930 in 2021 so far, as per data from Venture Intelligence.

The founders and early employees at these companies (40 unicorns)either already have some liquidity or will soon have some liquidity and will start investing in their friends and co-workers.

The founders and early employees at these companies either already have some liquidity or will soon have some liquidity and will start investing in their friends and co-workers.

In the coming years, we will see founders and early employees at these companies taking one or more of the following directions:

Start a startup

Join a startup

Become a part-time angel investor

Become a full-time investor

The bottom line is that the quality of ideas, the quality of the team executing those ideas, and the quality of the investors funding those ideas would be much more superior to what we have seen up till now.

Exclusive | $30 Billion Fundraising, 40 Unicorns In 11 Months — Startups Break Records, Spark…

2. Unicorn Club | Upstox’s Valuation To Soar To $3–3.5 Billion With New Funding Round Led By Tiger…

Online stockbroking platform Upstox will join the unicorn club with a fresh round of funding led by US investment giant Tiger Global. Upstox valuation post this round is expected to be in the range of $3–3.5 billion, according to sources aware of the development.

According to regulatory filings, Tiger Global has invested Rs 185 crore or $24.7 million in Upstox. However, the total quantum of funds raised in the round is not yet known. Entrackr was the first to report on this development.

This makes Upstox the 40th unicorn to emerge in 2021, a year that has seen massive investor interest in startups with fintechs leading the way. A unicorn is any privately held entity with a valuation of $1 billion or above.

The company’s last funding round of $25 million in 2019 was also led by Tiger Global. Since then the company has seen a steep increase in its user base led by the rising retail participation in the Indian stock markets. Upstox’s other investors include Tata conglomerate’s former chief Ratan Tata and Kalaari Capital.

Unicorn Club | Upstox’s Valuation To Soar To $3–3.5 Billion With New Funding Round Led By Tiger…

A podcast

A tweet

Worth your attention:

Spinny turns unicorn after raising $285 million from ADQ, Tiger Global and others Link

SoftBank-backed Snapdeal targets $250 million India IPO in 2022 Link

India’s Slice becomes unicorn with $220M funding from Tiger Global, Insight Partners and Advent Link

Razorpay seeks to raise $270 million Link

upGrad to buy Australia-based Global Study Partners for $16 mn Link

Exclusive: CRED to acquire expense management firm Happay Link

Exclusive: Rebel Foods tops up Series F round with Rs 108 Cr Link

Nithin Kamath explains why Zerodha values itself at only $2 billion. See post Link

Bessemer doubles down on Indian startups with new dedicated $220 million fund Link

Twitter CEO Parag Agrawal joins list of other Indian-origin executives Link